Total Investment Costs [€]

Area [m²]

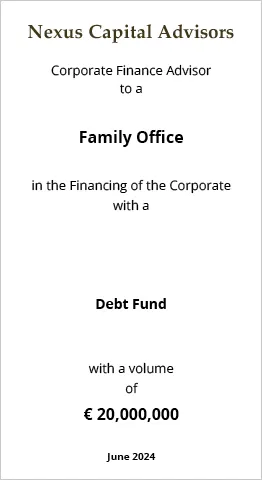

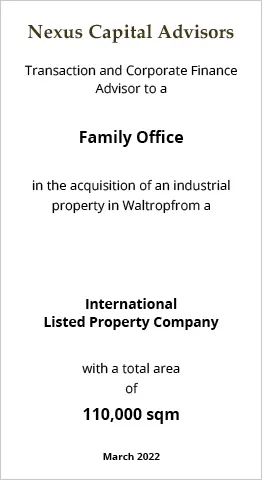

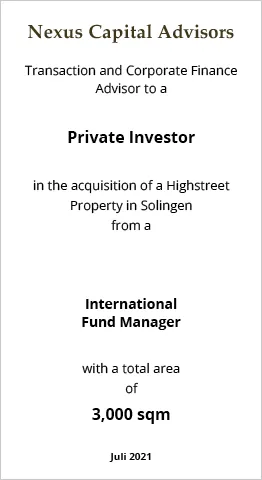

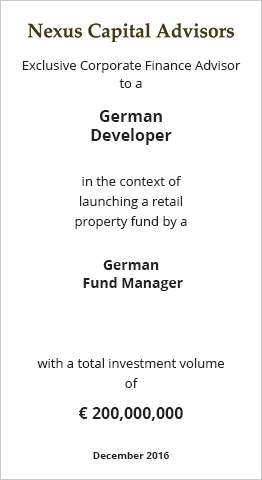

Nexus Capital Advisors offer comprehensive advisory services relating to the financing and refinancing of real estate, developments and companies as well as the acquisition of properties, portfolios, real estate loans and companies.

For our clients, we manage all real-estate financing related issues, in particular

Our clients benefit from our long-standing relationships with banks, alternative lenders such as debt funds, insurance companies, family offices and private equity investors.

We are familiar with financing alternatives available in the capital market and develop tailor-made solutions to optimise the capital structure. We are experienced in structuring for, and negotiating on behalf of, our clients to manage risk and identify opportunities.

We advise owners on finance-motivated transactions of owner-occupied properties, such as sale and leaseback of company buildings, and structure the entire process commencing with implementation of the strategy, via approaching investors, and through the SPA negotiations.

During a real-estate or company acquisition process we coordinate and oversee the entire due diligence process, assist our clients in developing the business case and advise in negotiations with the vendor and financing bank